Download Crunch and sign up using your name and email address. The first 60 days are free with unrestricted access to all our premium features.

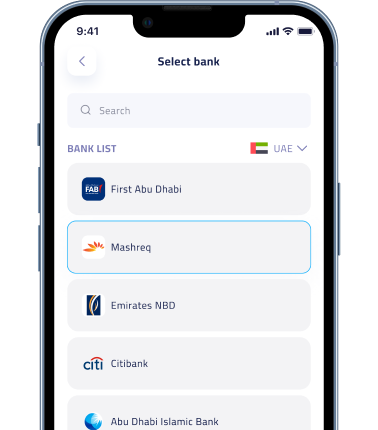

Sync your bank accounts or add things manually. Crunch will aggregate all your information in one single dashboard so you can easily track your net wo...

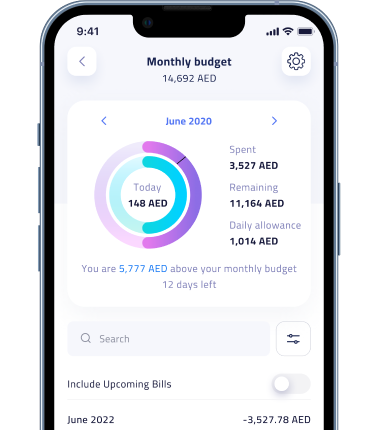

Once your monthly budget is set, Crunch keeps you on track by showing you where your money goes. Create unlimited manual budgets to monitor specific c...

See your personal & benchmarking insights at a glance in real time. Analyze your spending habits to get better at managing your money with just a few...

Crunch uses 3rd party providers regulated by the authorities and having very strict compliance and certification requirements such as ISO & GDPR. Once you select your bank, a new webpage opens that is not accessible to Crunch and is fully controlled by such 3rd parties to ensure your credentials are never seen, accessed, or stored.

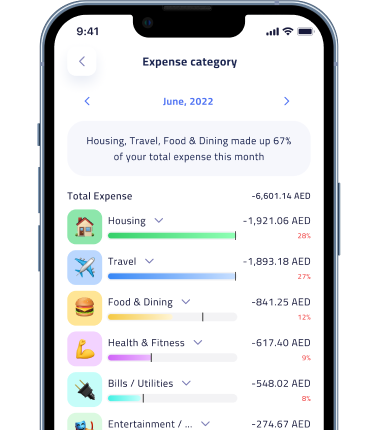

Crunch's Auto-categorization feature is 95% accurate. However, with Crunch's machine learning algorithm, the more you recategorize transactions to your preference, the more the model learns. It only takes a few times and a couple of clicks before you no longer have to worry about categorization.

Crunch will automatically detect transfers you make from accounts already connected to the app so you don't have to worry about it. If your transfer is to an account not connected to Crunch, you can simply edit the transaction and change it to a transfer type to keep your finances in check.

Crunch's categories and subcategories are fully customizable. You can choose to see categories only or dive into more detail and look at subcategories; you can also add, remove, modify, and rename categories and subcategories to suit your needs